The Economic Justice Imperative

Wealth creates opportunities: financial resiliency to withstand setbacks, access to capital to take risks, a network of wealthy friends/acquaintances to leverage, the ability to provide your kids with abundance of food, shelter, healthcare, educational support and life experiences that open doors to opportunity and lead to high expectations. Growing up with some degree of wealth is an enormous advantage and the absence of wealth is a correspondingly enormous disadvantage.

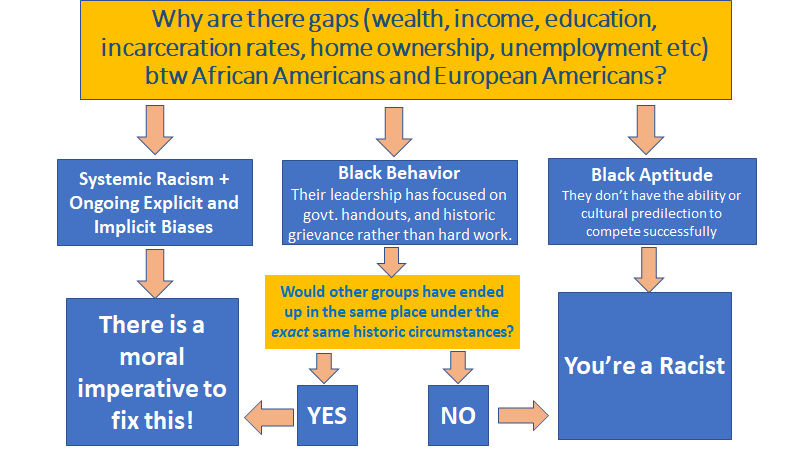

The median wealth of African American families is roughly 10% that of the median European American family, $17,150 vs $171,000. But unlike the wealth gap between rich and poor whites, the gap between whites and blacks was created intentionally by racially motivated laws, business practices and individual biases. From slavery, to Jim Crow, to lynchings and mass murder, to destruction of prosperous black business districts, to racially biased uses of eminent domain, to redlining, to government programs that benefited poor whites but not poor blacks like the Homestead Act and the GI Bill, to racial gerrymandering, to voter suppression, to individual biases that create unfair headwinds in education, job placement and career development, African Americans have faced unprecidented barriers to building wealth. We have an obligation to address this inequity. Closing the wealth gap will lead to the eventual closure of the other gaps as well; it is the central issue.

Ta Nehisi Coates made a powerful case for reparations in the Atlantic a few years ago. He also acknowledged that complexities of implementation would pose challenges beyond the politics of it. The complexities are pretty obvious and not trivial. Is Oprah eligible? Do poor white folks whose ancestors were also poor have to pay up? Do recent African Immigrants qualify for benefits? What if their ancestors participated in the slave trade in Africa? Do recent immigrants from Europe have an obligation to pay? What about people of mixed race? Sadly, I can’t imagine this country evolving to a point where such a program could be passed politically even without considering the complexities.

However, if we have rightfully pointed out that certain policies like poll taxes have a disproportionately negative impact on African American communities, a policy that creates a more level playing field economically for all would have a disproportionately positive impact on African Americans. Guaranteeing every child reasonably safe housing, healthy food, adequate healthcare and access to all the education that they can use would create genuine opportunity to compete in the marketplace, and would eliminate some of the political and practical complexities with a reparations-specific program.

Conservatives will say all this is too expensive and raising taxes would cost jobs, a safety net will lead to more lazy people, yadda yadda yadda.

However, there is a giant pot of money out there that could fund much of this, and redirecting that money would itself help create a more level playing field. In 2019 almost $765 Billion was transferred from one generation to the next in the form of inheritance. Over the next 30 years an expected $36 Trillion dollars will be inherited. This completely unearned income is almost entirely untaxed (the effective tax rate is 2%), and the preponderance of that money lands in the lap of white people who grew up in affluent households to begin with.

Conservatives and libertarians who believe this country is or should be a “meritocracy” should be all in favor of a 100% tax on this unearned income, but they have fought to eliminate estate taxes entirely instead. For all their talk of “Social Darwinism” and “the cream rising to the top” the truth is these folks don’t want poor kids to have a fair chance to compete with their own kids. They want to keep the game rigged for themselves and others like them for generations to come.

They will belly-ache about family farms having to be sold, and family businesses closed. They will share anecdotes of folks who worked their way to the top from humble beginnings and claim that they earned the right to pass that on to their descendants. All hog wash. It’s easy to make exceptions for small, family-owned and operated businesses. Moreover, those heartstring stories do not represent the majority of this wealth transfer. There is simply no argument for exempting shares in publicly traded stocks and bonds, vacation homes, etc. from taxation. No kid was born with a right to inherit wealth; the children and grandchildren of the rich should have to earn their own keep.

Kids who grow up in a reasonably affluent environment already enjoyed incredible advantages over the poor, which for “white” people is amplified by the anti-black racism that soaks this country’s very being. Why should those advantages then be compounded further through a nearly tax-free wealth transfer later in life?

An inheritance tax would not disincentivize economic success. People would still get to enjoy the fruits of their labor in their lifetime, and give their kids all those advantages as they grow up; they just wouldn’t get to anoint them with wealth like heirs to Aristocratic titles.

We should pursue hefty taxation of inheritance, but it is not going to happen in the near term. Generations of BS about “death taxes” have warped people’s understanding of the kind of Capitalism that works for the many, not for the few.

So what can people of good conscience do in the meantime?

Vote for politicians and push for party platforms that address economic justice as well as social justice; it’s not about handouts to people who haven’t succeeded, it’s about making sure their kids have a reasonable chance to compete.

Pass through some or all of the inheritance you receive to effective non-profit organizations that work for social and economic justice; if you talk the talk about economic justice, this is the hard part where you have to walk the walk.

In your own estate plans, leave what you have to those same non-profits, rather than leaving the bulk of your estate to your children and grandchildren.

Folks who know me well will point out that: 1) my wife and I don’t need inheritance money to retire comfortably whereas many people do; and 2) we don’t have children so “giving it all to charity” doesn’t involve hard choices for us. Fair enough.

Make it a conversation. It may be too difficult for parents to write their kids out of their estate plans, particularly if the children have planned careers around that inheritance. Perhaps the burden should fall to the progressive children of prosperous folks to raise the issue. Perhaps either group can and should initiate the conversation. The amounts don’t have to be all or nothing, either.

Recognizing “white privilege” is important. Protesting is important. But to create a more just society white folks who wish to be allies need to do more than that; we have to reject some of the privileges we receive ourselves. We have to stop heaping advantage on top of advantage on our kids and grandkids. If we are to help the “disadvantaged” we must first stop taking all the advantages that are available to us.